Borrowing money through a loan app has become a common financial decision for many individuals who want quick access to funds without visiting physical offices. However, choosing the right loan app requires careful evaluation. Before committing to any borrowing decision, people usually compare multiple factors to ensure the loan suits their financial condition. This is where understanding loan structures, repayment terms, and professional support like ca loan consultation becomes important. Selecting the best personal loan is not about speed alone but about long-term affordability and clarity.

This article explains the key loan app options people usually check before borrowing money and how these factors influence responsible borrowing.

Understanding Loan Apps and Their Purpose

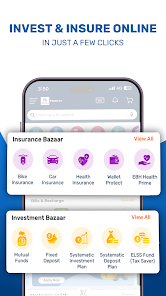

Loan apps are digital platforms that allow users to apply for loans through mobile or web-based systems. These platforms simplify documentation, verification, and disbursal. While the process may appear straightforward, users still need to assess whether the loan terms align with their income, repayment ability, and financial goals.

Many borrowers also seek ca loan advice to understand how a loan may affect their tax planning or long-term financial stability. This step is often overlooked but plays a vital role in informed decision-making.

Eligibility Criteria Borrowers Review First

Income and Employment Requirements

Before applying, users usually check income limits and employment eligibility. Some loan apps cater to salaried individuals, while others support self-employed applicants. Understanding eligibility reduces rejection chances and avoids unnecessary credit checks.

Credit History Expectations

Most loan apps review credit scores before approval. Borrowers often compare apps that provide flexibility for different credit profiles. Those seeking the best personal loan generally prioritize options that balance fair interest rates with reasonable eligibility conditions.

Interest Rates and Cost Structure

Fixed vs Variable Interest

One of the most important loan app options people check is interest type. Fixed interest provides predictable monthly payments, while variable rates may change over time. Borrowers compare both to choose what suits their financial comfort.

Additional Charges

Loan apps may include processing fees, late payment charges, or prepayment penalties. Reviewing the complete cost structure prevents unexpected financial pressure later. A ca loan professional can help interpret these charges clearly before finalizing a loan.

Loan Amount and Repayment Flexibility

Minimum and Maximum Loan Limits

Borrowers assess whether the loan app offers amounts that match their requirements. Applying for more than needed often increases repayment burden, while insufficient amounts may not solve the financial issue.

Repayment Tenure Options

Flexible repayment periods allow borrowers to plan monthly budgets better. Longer tenures reduce monthly installments but increase total interest, while shorter tenures close loans faster. Choosing the best personal loan involves balancing these factors carefully.

Application Process and Documentation

Digital Verification Process

Many people prefer loan apps with simple documentation and secure verification. Common documents include identity proof, income proof, and bank statements. Borrowers check whether the process is transparent and time-efficient.

Approval and Disbursal Time

Quick approvals attract users, but speed should not be the only deciding factor. Responsible borrowers ensure that fast processing does not compromise clarity in loan terms or repayment obligations.

Transparency and Terms Clarity

Clear Loan Agreement

Before borrowing money, users read loan agreements to understand repayment schedules, penalties, and borrower responsibilities. Transparent loan apps provide detailed terms without complex language.

Support and Guidance

Some borrowers consult ca loan professionals to review agreements and confirm whether the loan aligns with their financial planning. This step helps avoid misunderstandings and future disputes.

Data Security and Privacy Practices

Loan apps collect sensitive personal and financial information. Users check privacy policies to ensure data is protected and not misused. Secure platforms build trust and confidence during the borrowing process.

Impact on Financial Planning

Monthly Budget Assessment

Borrowers evaluate how loan repayment affects monthly expenses. A well-chosen loan should fit comfortably within income limits without disrupting essential spending.

Long-Term Financial Goals

Loans should not block savings, investments, or emergency planning. Many individuals consider professional ca loan guidance to ensure borrowing supports rather than harms long-term goals.

Responsible Borrowing Habits

Borrow Only What Is Necessary

Loan apps make borrowing easy, but responsible users apply only for required amounts. This approach reduces interest burden and repayment stress.

Compare Multiple Options

Comparing different loan app features helps borrowers identify suitable terms. The best personal loan is one that meets needs while maintaining financial stability.

Common Mistakes People Avoid

- Ignoring total repayment amount

- Overlooking penalties and fees

- Choosing loans without checking repayment capacity

- Skipping professional ca loan consultation

Avoiding these mistakes leads to healthier borrowing decisions and better financial outcomes.

Conclusion

Loan app options people check before borrowing money go far beyond quick approvals. Borrowers carefully review eligibility, interest rates, repayment flexibility, transparency, and data security before making a decision. Seeking ca loan advice adds an extra layer of financial clarity, especially for those managing long-term commitments. Ultimately, selecting the best personal loan requires thoughtful comparison, responsible planning, and clear understanding of repayment obligations. When chosen wisely, a loan app can support financial needs without creating unnecessary stress.